The Capitalization Rate or CapRate, is one of the most useful financial tools to determine how good a Real Estate investment can be.

The CapRate is calculated by dividing the net operating income, between the value of the assets of the property. This means it is considered an attractive CapRate for an investor or property owner to have at least 6% in an average size city; 7% in a more developed city such as Monterrey and 8% in a Beach Destination.

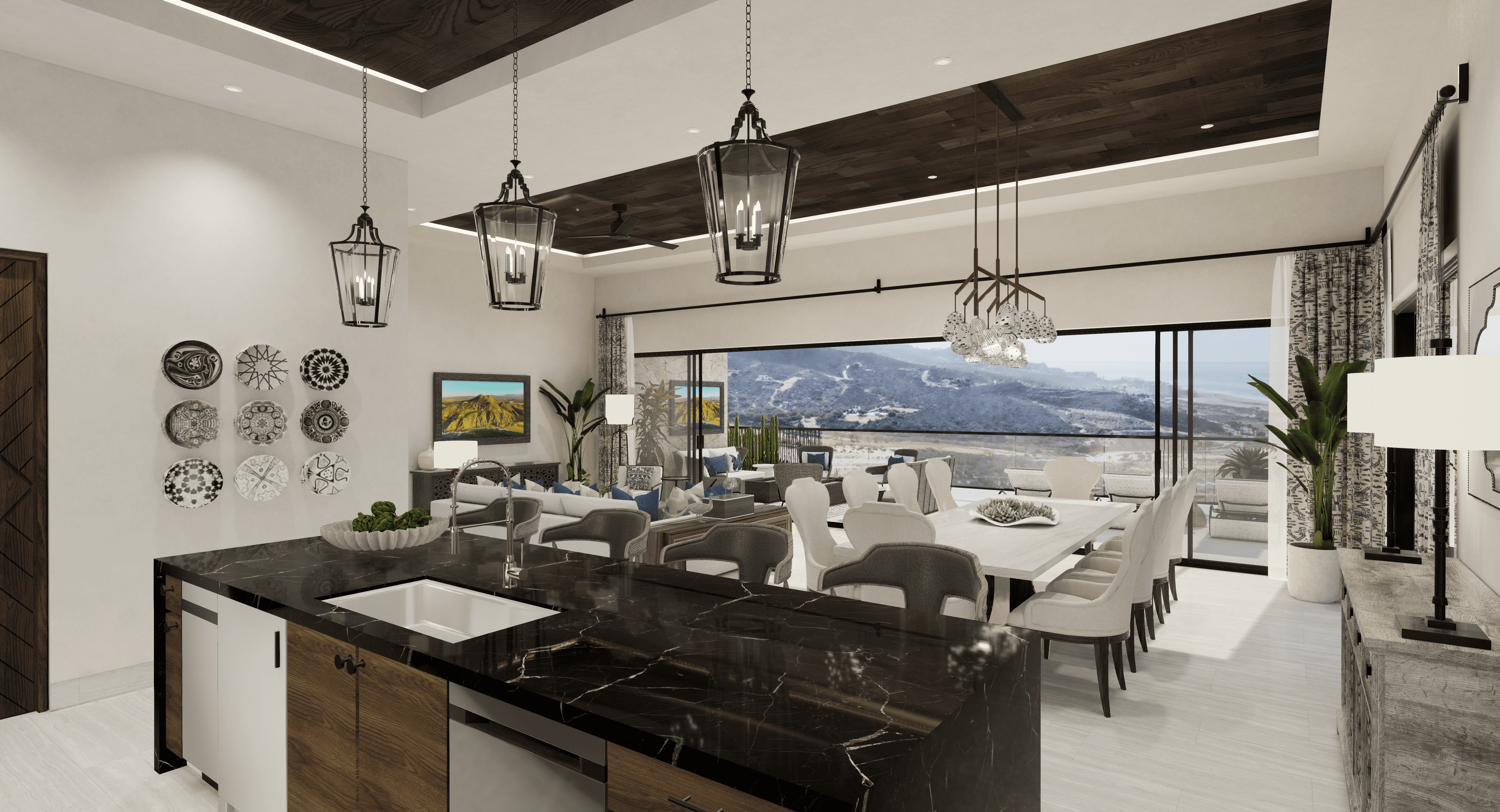

The following study case includes actual figures for a two-bedroom, one rooftop condominium in Mavila, one of the Quivira Communities in Cabo San Lucas:

The price paid by the owner was $240 thousand US dollars six years ago, and it comes furnished with an investment of $20 thousand dollars. Operating expenses include a maintenance payment for the common areas of $200 dollars and $100 dollars more for water and electricity services.

An apartment with these charcateristics is rented for $2800 dollars per month, from which we can obtain a CapRate of 11.66% which is a considerably high percentage for a Beach Destination.

In those six years, the price of a new property with similar characteristics has increased to $580 thousand dollars and with this, the CapRate would be 4.82% which does not make it interesting in terms of averages recognized by the Real Estate Market.

However, in those six years, in a mix between surplus value and the inflationary effect, the price in dollars has increased by 140% and a few destinations can show such positive figures in such a short period of time.